Breaking the Chain

AI, capital cycles, and why flexibility matters more than speed

It’s that time of year when we’re reminded who really runs the universe.

No, not the Super Bowl. That spectacle comes this Sunday.

This past week belonged to Big Tech earnings.

And as usual, earnings season didn’t settle the AI debate. It reframed it, and if anything, pushed it further to the top of investors’ minds.

Even as some of the most thoughtful voices in the field describe AI as still being in its “adolescent” phase (The Adolescence of Technology) powerful, fast-evolving, and far from fully formed, January offered evidence that from a market perspective, AI has aged up to its next stage.

The earnings calls of the Magnificent Seven made the shift unmistakable. The discussion was no longer about whether the technology works or how fast capabilities are improving. Rather, updates were anchored in usage data, monetization trends, margin impacts, and (most importantly) capital allocation decisions.

AI is no longer a future promise; it is reshaping how the world’s largest platforms spend, invest, and compete.

Meta, Microsoft, and Apple each illustrated a different aspect of this dynamic.

Meta provided one of the clearest examples of AI leverage: better ad targeting translated directly into higher engagement and conversion, supporting increased forward investment. Microsoft’s results highlighted the complexity of AI monetization at hyperscale, strong demand and backlog growth offset by rising capital intensity and concentration risk. Apple, meanwhile, continued to take a more measured approach, delivering solid results driven by iPhone demand and Services growth while positioning AI as a long-term enhancement to its ecosystem rather than a standalone product.

“AI is positively impacting every part of the business.” - Sundar Pichai, CEO of Google

Taken together, these results tell a consistent story.

AI demand is real. Usage is accelerating. Monetization is happening. But so is capital intensity.

That reframing at the platform level has had second-order effects across the market, most notably in the sharp divergence in investor behavior between software and semiconductors.

You Can Go Your Own Way

This combination, accelerating demand alongside rising capital intensity, is where cycles quietly determine who endures… and who discovers the music was holding together longer than the band.

Which brings us to our analogy of the day.

The AI market today looks a lot like Fleetwood Mac at the height of Rumours.

From the outside, everything appeared cohesive. The music was incredible. Commercial success was undeniable. But beneath the surface, the band was already fractured. Each member operating under different incentives, different constraints, and increasingly divergent paths forward (including a few public breakups), all while performing under the same banner.

AI is at a similar moment.

The ecosystem still trades as a single story, but structurally it has begun to fracture. What this earnings season revealed wasn’t disagreement about whether AI works. It revealed who has flexibility, and who is locked into the tour schedule no matter what.

On one side are AI adopters: companies using AI to enhance existing platforms, workflows, and monetization engines. For these businesses, AI acts as operating leverage. Costs are largely variable. Deployment can be phased. Investment can be slowed, bundled, or redirected as economics become clearer. If assumptions change, adjustments are possible.

On the other side are AI builders: semiconductor manufacturers, data center hardware suppliers, cloud infrastructure providers, and the power and grid assets that support them. Here, capital is front-loaded, fixed, and largely irreversible. Capacity must be built years in advance of realized demand. Returns depend on sustained utilization, continued scarcity, and long-duration growth assumptions holding together.

Both are on the same stage, but only one has the freedom to change the set.

The Landslide Brought (Software) Down

With that framework in mind, it’s worth looking at how these two groups have actually performed.

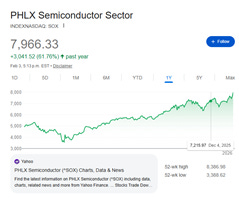

Semiconductor stocks have continued to outperform, with the SOX index up roughly +17% YTD. Software, by contrast, has experienced a sharp and broad-based sell-off. The pressure has spanned mega-cap to small-cap, sweeping up even companies previously viewed as relatively insulated from AI disruption. This has looked less like selective risk assessment and more like a mass exodus.

The latest catalyst has been Anthropic’s release of new plugins for its Claude Cowork product, tools designed to move Claude from a chatbot toward an agent capable of executing tasks across files, browsers, and departmental workflows. The reaction has been swift: fears that AI agents will rapidly displace traditional enterprise software have resurfaced … with force.

In our view, this is where rate-of-change anxiety risks overshooting reality.

It is a significant leap to assume that productivity tools or AI agents will prompt enterprises to abandon decades of mission-critical software, compliance systems, and deeply embedded workflows in favor of these alternatives. Adoption is real. Replacement is slower, more selective, and far more constrained than current market pricing suggests.

Which bring us back to one of our favorite topics: investor psychology.

Today’s environment increasingly resembles 2020–2021 … or rather, to borrow from Willy Wonka, “Strike that. Reverse it.”

What we’re seeing now looks like the mirror image of that period. Back then, software was purchased indiscriminately at peak valuations under the assumption that cloud growth was limitless and capital costs were irrelevant. Today, many of those same institutions are selling software at valuation levels last seen decades ago, driven less by fundamentals and more by fear.

What makes the moment particularly disheartening is that even healthy results are being met with heavy selling pressure. While not every company will clear a high bar this earnings season, the degree of pessimism suggests expectations have already shifted from skepticism to outright capitulation.

But it is important to remember, capital doesn’t leave markets, it rotates.

As concerns around AI disruption have intensified, capital has moved away from traditional software and upstream toward parts of the AI stack perceived as more tangible, more essential, and less discretionary. That rotation has been most visible in semiconductors, where demand feels easier to quantify and scarcity easier to underwrite.

Semis are Everywhere (But at a Price)

McKinsey estimates the semiconductor industry was valued at roughly $630–680 billion in 2024 and is expected to surpass $1 trillion by the end of the decade, driven largely by AI and data center demand. Some analyses suggest even higher potential once in-house chip design, advanced packaging, and under-reported markets such as China are fully accounted for.

That growth is real. But it is also uneven.

Most of the incremental value creation is concentrated in a narrow set of leading-edge chips and high-bandwidth memory, where winner-take-all dynamics dominate and capital requirements are extreme. Outside those segments, competition is intense, pricing power is weaker, and cost discipline becomes critical.

At today’s valuations, markets are increasingly pricing semiconductors not just for growth, but for durability, assuming that today’s scarcity persists, utilization remains high, and incremental capacity earns attractive returns over long horizons. That leaves little room for execution missteps, demand volatility, or normalization as supply responds.

Scale, in other words, does not eliminate risk. It concentrates it.

None of this is to suggest that semiconductors are a bad investment. There are real opportunities across the space. But there are also real risks, particularly in an environment where capital is expensive, capacity is being built aggressively, and expectations implicitly assume that scarcity lasts indefinitely.

In capital-intensive industries, valuation doesn’t fail gradually. It fails when assumptions stop holding all at once.

Time to Break the Chain

As AI moves deeper into deployment, the rules of the game begin to shift.

Early in technology cycles, success is measured by speed, who can build fastest and capture attention. In later stages, success is measured by discipline who can generate returns without continuously expanding the balance sheet.

That transition is already underway.

For Adopters, this phase tends to be forgiving. They can pause, integrate, and monetize selectively. For Builders, it is less forgiving. Assumptions must be right, repeatedly. Errors don’t arrive gradually they surface through misutilization, margin compression, and balance-sheet stress.

As AI moves from experimentation to deployment, optionality becomes the scarce asset. The ability to wait, adapt, and monetize quietly becomes more valuable than the ability to build capacity quickly.

For investors, this phase of the AI cycle argues less for chasing what’s building fastest and more for owning what can adapt without being forced to.

You Make (Investing) Fun

What made the Rumours era so enduring wasn’t just the music, it was that the band managed to produce something everlasting despite being structurally misaligned.

But markets don’t get to enjoy the album after the fact. They have to make it through the world tour.

Looking at AI, the output still looks cohesive, progress is undeniable, but, beneath the surface, incentives have already diverged. Some participants retain the freedom to adapt as conditions change. Others are bound by commitments made years in advance, with little room for error.

In cycles like this, success isn’t about who sounds best in the moment, but who can survive when the music stops.

Company Specific Updates:

MDA – link - Bloomberg reports that MDA is aggressively recruiting global talent as defence spending fuels a new space boom. Governments, particularly in Canada and allied countries, are pouring money into satellites, robotics, and space-based intelligence for military and national-security uses, sharply increasing demand for highly specialized engineers and scientists. MDA is benefiting from major defence-linked contracts including military satellite communications and surveillance systems but faces intense competition for skilled workers in a tight global labour market. To keep pace, the company is expanding hiring beyond Canada, positioning itself as a key player in a rapidly militarizing space economy where talent shortages risk becoming a bottleneck to growth.

Exchange Income – has acquired Florida-based commercial aviation aftermarket company, MACH 2, for US$43M (US$34M in cash and US$9M in stock). EIF says that MACH 2 does not target the regional segment of the market, so there is < 5% overlap with their Regional One business.

Dye & Durham – has filed their FY25 and Q1 FY26 financial statements, with revenue and adjusted EBITDA largely in-line with what was communicated by the company when they released preliminary results this past December. DND says that their reconstituted Board can now work towards a comprehensive strategic plan and they expect to outline their full strategy “in the coming weeks”. They did not declare a dividend, saying they would defer such a decision until strategic planning is complete. DND’s AGM/SGM will be on March 4th.

5N Plus Inc. - Announced that its wholly owned subsidiary AZUR SPACE Solar Power will further expand its space solar cell production capacity by about 25 % in 2026, adding to previous increases of 30 % in 2025 and 35 % in 2024 to meet strong demand for advanced solar technology used in satellites and space missions. The new capacity is expected to come online gradually starting in the second half of the year, with the company leveraging existing space and process improvements rather than major new investments. This continued expansion reflects a robust order backlog and growing customer needs driven by trends like AI, connectivity, and space observation/security applications

On Friday 5N Plus also announced an $18 million investment from the U.S. Department of Defense to expand U.S. germanium refining capacity at 5N’s Utah facility by approximately 7x.

Pender Events + Publications

We’re pleased to announce that Teresa Lee has joined Pender as Head of Equity Research. She will also work with David Barr on the Pender Global Small/Mid Cap Equity Fund. Teresa brings over 25 years of investment management experience, with a focus in small-cap investing. She previously led small cap, all cap, and high-conviction strategies at Sionna Investment Managers where she spent 16 years, becoming Co-CIO in 2015. We believe that small cap equities are an area with significant potential to add value to client portfolios and Teresa’s arrival strengthens Pender’s active, fundamentals-driven small-cap investing capability, adding depth and breadth to our equity research and investment process. Read the full announcement here: https://bit.ly/3LTlP5k

Upcoming Webinar: Credit Market Update - Join Justin Jacobsen, Portfolio Manager, for a discussion and update on the Pender Alternative Absolute Return Fund. Justin will cover: Reflecting on markets and the Fund positioning in 2025, Today’s markets and valuations, Looking ahead and positioning for 2026. Date: Wednesday, February 11, 2026 Time: 10am PST. Register: https://bit.ly/4a3SAoj

Pender Growth Fund Portfolio Company, General Fusion, Announces a Proposed Business Combination – link - Pender Growth Fund’s portfolio company General Fusion has entered into a definitive agreement to merge with Spring Valley Acquisition Corp. III, a SPAC, which is expected to result in General Fusion becoming a publicly traded company on the Nasdaq under the ticker “GFUZ”. The proposed transaction implies a pro-forma equity value of about US $1 billion and is anticipated to close in mid-2026, subject to approvals. If completed, the deal is expected to increase Pender Growth Fund’s NAV and provide capital to advance General Fusion’s fusion energy technology program. The move reflects confidence in fusion’s potential role in future energy systems and aligns with long-term investment themes around the energy transition.

Insights at the intersection of defense, geopolitics, and long-term investing - At Pender, our equity team focuses on identifying opportunities at the intersection of sector and capital cycles, structural change, and market inefficiencies. Our core themes include Enterprise Software, AI, the Energy Transition, and the evolving geopolitical environment — with this paper exploring Defense as a key expression of today’s geopolitical shift, supported by a companion podcast featuring the Retired Vice Admiral Mark Norman.

The Intelligence Wars: Defense Spending, Technology, and the Global Realignment - White Paper - Global defense spending is entering a new era, defined by intelligence, technology, and industrial resilience. As nations rearm and supply chains adapt, trillions of dollars are being deployed. For Canada, this represents a strategic shift as well as an investment opportunity as defense spending accelerates and industrial capacity expands. Across themes — from the energy transition to digital infrastructure to defense innovation — governments, corporations, and investors are re-evaluating where value is created and protected in the new geopolitical climate. At Pender, we see this as part of a broader capital cycle — one in which structural tailwinds, innovation, and disciplined capital allocation will determine the long-term winners in an evolving global landscape.

Podcast – link - In this episode of the Pender Podcast, Laura Baker, Associate Client Portfolio Manager, is joined by Retired Vice Admiral Mark Norman to discuss Canada’s evolving defense landscape and why it matters in today’s geopolitical and investment environment. Drawing on decades of military leadership and policy experience, the conversation explores defense readiness, procurement challenges, Arctic security, and the growing intersection between national security, technology, and capital markets.

Pender Credit Opportunities Fund Q4 - Parul Garg’s commentary reflects on Q4 and includes an outlook for 2026. The Fund was up 13.7% for the year; the benchmark returned 7.3% for the same period. A consistent, bottom-up approach helped turn dislocations into opportunities. We are thinking about risk and return through the lenses of fundamentals and valuation. “We believe the opportunity set for our investment style and philosophy is deeper and broader than it has been in some time even with major market indices sitting near record highs and valuations remaining above normal.” Read the full manager’s commentary: https://bit.ly/4qaYkCX

Pender Market Insights – In this edition, Greg Taylor explains how momentum defined 2025, with global equity markets delivering a third consecutive year of strong gains and finishing the year at all-time highs, despite bouts of volatility, policy uncertainty, and geopolitical noise. Looking ahead to 2026, Greg is tracking where rate policy, geopolitics, and a potential rotation toward undervalued international markets may shape the next phase of returns. As the market enters the new year with a healthier, more diversified foundation, the opportunity set appears wider but selectivity remains key. Read the full commentary here: https://bit.ly/4qN8sCH

Podcast Episode: Deploying Generative AI and Other TMT Predictions – link - We are pleased to welcome back Duncan Stewart, Director of TMT Research at Deloitte Canada, for Pender Ventures’ annual Technology, Media, and Telecommunications (TMT) update. Hosted by Maria Pacella, Managing Partner at Pender Ventures, this wide-ranging conversation explores Deloitte’s 2026 TMT Predictions and what they mean for investors, operators, and policymakers. Duncan shares insights on AI-driven economic growth, data center infrastructure, agentic AI, robotics, energy constraints, and the narrowing gap between AI promise and reality.

Webinar Replay Now Available: Credit Markets Outlook and Top Ideas for 2026. Geoff Castle, Lead Portfolio Manager and Emily Wheeler, Portfolio Manager share their perspective on the credit landscape heading into 2026, drawing on the Pender Corporate Bond Fund’s recent performance to discuss where risks are building and where opportunities may be emerging. In this session, the Fixed Income team covers: Outlook for credit markets in the year ahead, Key risks investors should be watching, Top ideas influencing portfolio positioning for 2026. Watch the webinar replay here: https://bit.ly/4sAvgHu

Market Snacks

Just 32.4% of startups founded by Canadians that raised more than $1 million were actually based in Canada in 2024, according to a new study. (link )

Y Combinator says it won’t invest in Canadian startups that won’t leave Canada. The incubator quietly changed its deal terms and now requires Canadian startups to reincorporate in the U.S., the Cayman Islands, or Singapore. One founder accused YC of “sell[ing] a story that implies ‘Canada can’t win unless you leave.’ But in a series of X posts, YC CEO Garry Tan defended the move: “Where you are incorporated increases your access to capital. That’s it.”

It could be a record-setting year for IPOs. In fact, Blackstone’s president said the company had lined up one of the largest IPO pipelines in their history. Two of the most important candidates are SpaceX and OpenAI. Other potential 2026 IPO candidates include Anthropic, Databricks, Strava, Canva, Stripe, and Ledger.

SpaceX and xAI merge to create a US$1.25 trillion company. The two Elon Musk-owned companies have merged ahead of what’s expected to be the biggest IPO in history later this year. The deal brings together two of the most valuable private companies in the world and further consolidates Musk’s sprawling businesses. The idea of Tesla being folded into the same company has reportedly been explored by management. (Reuters)

Scotiabank gets into the defence business. The lender will join RBC as the first two Canadian banks to sign on in support of the Defence, Security and Resilience Bank, a new international institution dedicated to bankrolling defence projects. (Globe and Mail)

Disney is reportedly tapping the head of its theme parks division, Josh D’Amaro, as its next CEO. Bob Iger, who has held the top job for nearly two decades, will step down from the role before the end of the year. (Reuters)

Macro Morning

Pierre Poilievre wins landslide leadership vote. Delegates at the Conservative Party convention voted overwhelmingly to keep Poilievre on as leader, with 87.4% of votes cast in his favour. Poilievre remains behind Prime Minister Mark Carney in national polls. (Globe and Mail)

Ukrainian President Volodymyr Zelensky said trilateral peace talks with Russia and the US will resume this week in Abu Dhabi.

The UAE’s intelligence chief bought a 49% stake in the Trump family’s World Liberty Financial, days before President Trump’s inauguration last year, according to the Wall Street Journal.

The Trump administration is cutting tariffs on India after it agreed to quit Russian oil. Tariffs on Indian imports will drop from 25% to 18% as part of the new deal, while Indian Prime Minister Narendra Modi also committed to stop buying Russian oil. (Bloomberg News)

Technology Today

Waymo is eyeing a US$110 billion valuation. The robotaxi company is aiming to raise $16 billion in new funding, with the majority expected to come from its parent company, Alphabet. The raise would more than double Waymo’s previous $45 billion valuation from October 2024. (Bloomberg News)

Nvidia is pumping the brakes on its US$100 billion deal with OpenAI. The chipmaker’s CEO, Jensen Huang, says they never fully committed to an investment in OpenAI, and that they would explore any future funding rounds one at a time. People within Nvidia reportedly expressed serious doubts about the deal — which was announced back in October — with Huang himself privately expressing concern about a lack of discipline in OpenAI’s business approach. (Wall Street Journal)

Apple may launch a flip-style foldable iPhone Link - Though the company has not confirmed these plans and the device is still under development. Apple expects its book-style iPhone Fold, set to launch in the second half of this year, to take folding phones mainstream where Android vendors like Samsung and Google have not succeeded. The company is also working on a larger book-style foldable that will become its flagship iPhone, sitting above the original iPhone Fold, though no release date or technical details were shared.

Oracle plans to raise $50 billion for cloud expansion Link - Oracle announced plans to raise between $45 billion and $50 billion in 2026 to expand its cloud infrastructure, using a mix of debt and equity sales to meet demand from major customers. As a reminder, Oracle’s stock has dropped more than 50% from its September high, losing over $460 billion in value, as investors worry about whether big AI-related spending will actually pay off.

Oh also the recent TikTok outage was due to an Oracle data center going down Link

Blue Origin pauses space tourism flights for two years LINK - The New Shepard rocket has flown 38 times over the past decade, carrying 98 humans past the Kármán line and more than 200 scientific payloads into space. The pause comes as President Trump pressures NASA to land astronauts on the moon before his term ends, opening opportunities for companies beyond SpaceX to compete for lunar missions. the company is now focusing all of its resources on upcoming missions to the moon.

StatCan found Canada’s fertility rate hit a record low of 1.25 children per woman in 2024, putting the country in the “ultra-low fertility” category. (link)

AI of the Tiger

Moltbook, a new social media platform designed for AI agents to interact with each other autonomously which has (not unfairly) sparked some dystopian fears in the process. Tesla’s former head of AI called Moltbook, “the most incredible sci-fi takeoff-adjacent thing” he has seen recently. The website now has tens of thousands of posts, which it says are generated by AI agents independent of human intervention.

Hot topics include which you may expect: venting about prompts, jokes about human users, and ways to improve productivity. More worrying for some are debates on the platform about consciousness and discussions around the need for agents to have encrypted communication channels or secret languages that humans can’t understand. Yeah wow ok…

NYC Mayor Zohran Mamdani is shutting down the city’s rogue AI chatbot. The municipal AI tool, aimed at helping businesses navigate government programs, will be terminated following reports that it recommended business owners break the law, including stealing their workers’ tips. Safe to say this particular Eric Adams experiment didn’t go quite to plan. (The Verge)

SpaceX seeks approval for 1 million AI satellites LINK - SpaceX has filed an application with the FCC to launch one million satellites into Earth’s orbit, designed to serve as orbital data centers that support growing artificial intelligence infrastructure needs. The company claims that terrestrial data center resources are becoming exhausted, and these solar-powered satellites could offer better cost and energy efficiency with lower environmental impact than ground-based options.

India offers zero taxes through 2047 to lure global AI workloads LINK

Apple ‘runs on Anthropic,’ says Mark Gurman Link - According to Bloomberg reporter Mark Gurman, Apple heavily depends on Anthropic technology for building its products, with employees at the company saying it essentially “runs on Anthropic.” Apple’s deal with Google costs about one billion dollars annually, much less than Anthropic’s asking price, which also included a plan to double fees over time.

Toronto-based autonomous vehicle startup Waabi closed a US$750 million funding round, marking one of the largest venture capital raises in Canadian history. The company also announced a new tie-up with Uber to launch a fleet of at least 25,000 robotaxis in the near future. Waabi says it’s the first company to build what it calls a shared “AI brain” that can operate everything from trucks to drones to warehouse robots.

Crypto Corner

Coinbase, JPMorgan CEOs clashed over market structure bill at Davos: Report Link

US imposes sanctions on crypto exchanges tied to Iran (CD)

Michael Saylor’s bitcoin stack officially underwater (CD)

CZ denies crypto market crash accusations (BBG)

Coinbase shareholder lawsuit over insider trading proceeds (CT)

Binance pledges $1B fund to bitcoin (TB)

Vitalik Buterin spends $43M on Ether development (DC)

Tokenized equities market explodes by 3,000% in single year (CD)

Bitcoin mining profits hit 14-month low (DC)

Bitwise says bitcoin could hit $6.5M in 20 years (CD)

SoFi posts $1B revenue quarter amid crypto expansion (TB)

Energy Transition Today

AI power needs may turn LNG glut to gap by 2030, says Qatar Energy CEO

Alphabet’s Google, Singapore Airlines and DBS Group Holdings are among companies that will test the city-state’s plan for central procurement of sustainable aviation fuel.

The refurbishment of Ontario’s Darlington nuclear plant is done ahead of schedule and under budget. Those are words you don’t often hear when it comes to large infrastructure projects. (CBC News)

The Dig

Eldorado Gold is buying Foran Mining (FOM CN) in a deal that will see FOM holders receive 0.1128 ELD shares and a penny in cash. Based on Friday’s ELD close, that implies $6.60/share in-line with where FOM closed. The $3.8B market cap acquisition will see FOM shareholders own about 24% of the combined company. FOM’s McIlvenna Bay copper mine in northern Saskatchewan is expected to come into production this year. ELD says that with their Skouries project and FOM’s McIlvenna Bay both coming on-line, the combined company would generate about US$2.1B of EBITDA and US$1.5B of FCF in 2027, assuming US$3,965/oz gold and US$5.02/lb copper.

Gold and silver are bouncing around after a brutal Friday that saw silver plunge 28% — its worst day since 1980 — and gold drop nearly 10%.

The U.S. is creating a US$12 billion critical mineral stockpile. In a bid to reduce dependence on China, the U.S. will begin stockpiling minerals for automakers and tech companies. It will be the first-ever resource stockpile for the U.S. private sector, a strategy that China has used. (Bloomberg News)

The Picks List

I don’t know why this surprised me but the 2026 Winter Olympics officially begin on Friday with the opening ceremonies, though competition will get underway on Wednesday with skiing, curling, and luge events. With NHL players returning to the games for the first time since 2014, Canada is expected to compete for gold in men’s hockey and turn in strong performances in curling, freestyle skiing events, and speed skating.

You’ll soon be able to buy the viral Team Canada sweater from Heated Rivalry.

Answering the internet’s top questions about Olympic history.

All of the new sports at the Milano-Cortina Olympics.

Also the Super Bowl is this weekend - The New England Patriots and Seattle Seahawks will battle for the Lombardi Trophy on Sunday. If you haven’t been paying attention to the football season, here’s some basic prep: Seattle are the favourites, with Vegas giving them a ~70% chance to win.

US$10 million. Price that some brands are paying for a 30-second ad slot for this year’s Super Bowl, a new record

The Breakroom

Yesterday was Groundhog Day, and Punxsutawney Phil saw his shadow, indicating that there’ll be 6 more weeks of winter weather — though it’s important to remember that Phil is only actually right about 35% of the time.

Canada’s most famous furry forecaster, Wiarton Willie, predicted an early spring. His Quebecois counterpart, Fred la Marmotte, was aligned and also foresaw warmer weather.

Nova Scotia’s Lucy the Lobster also made a prediction

Columbia Sportswear has partnered with a Portland brewery to release a limited-edition beer brewed with bear poop-infused water. Yes I know…. The certified “safe-to-drink” lager which is a pretty terrifying classification honestly, is, apparently, “clean-tasting.” Great. Amazing. Love that for them.

Out in the field with the worm hunters of Southern Ontario.

Swiss researchers built a six-fingered robot hand that can detach from its arm and crawl around independently. The team says the extra finger was added to improve on our “reliance on a single thumb,” which limits what we can do (like pick up multiple items at the same time), and that the detachable design could help with “industrial, service, and exploratory robotics.” The hand can grip up to four objects at once and hold something while walking on its remaining fingers, which is objectively impressive and also deeply upsetting. (watch it here).

Please read important disclosures at www.penderfund.com/disclaimer.

Standard performance data for Pender Funds can be found at www.penderfund.com/solutions/

I love the way you separate speed from flexibility here. The Fleetwood Mac analogy makes the capital intensity divide between builders and adopters feel intuitive without oversimplifying it. The point about optionality becoming the scarce asset is especially sharp, because that’s what markets often misprice in the middle of a hype cycle. It also feels timely to frame this as a rotation story rather than a collapse story. This reads like a reminder that durability, not excitement, tends to win long tours.